Energy Saving Tax Credits 2025. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero. Specifically, credit limits will be the following:

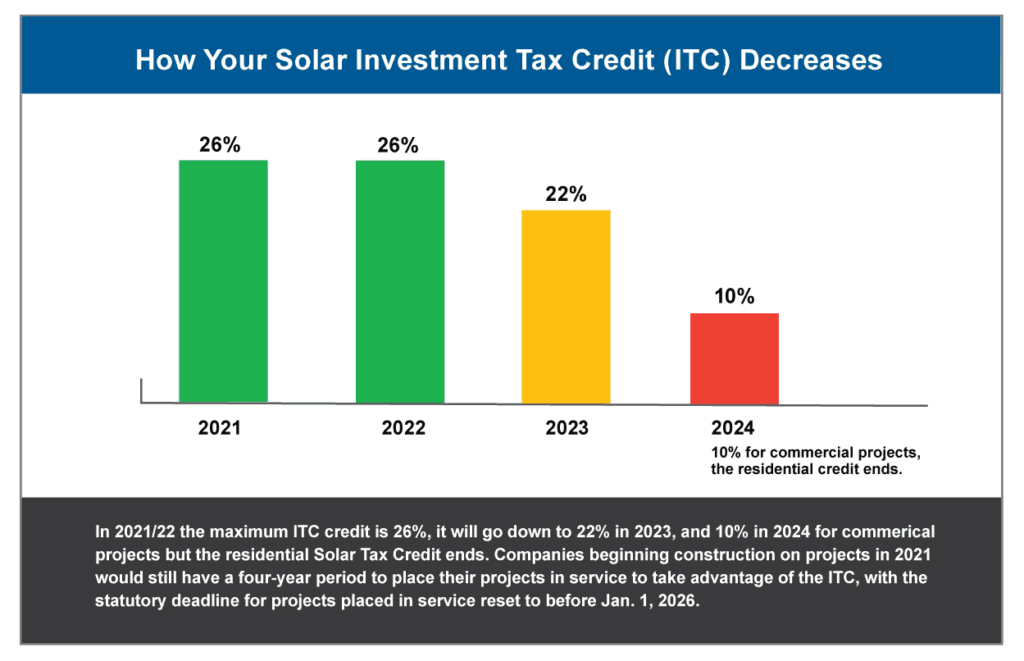

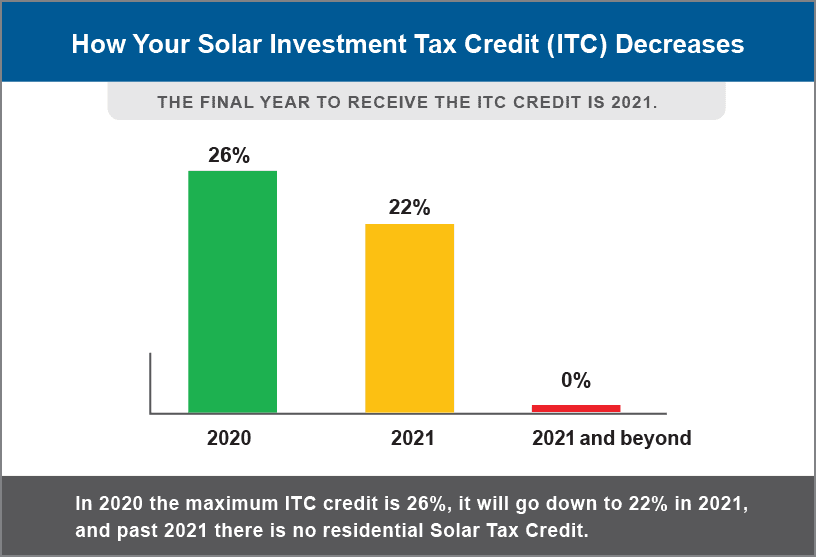

Expanding the ira by doubling the tax credits for the power sector — the production tax credit, investment tax credit, and the credit for nuclear — would accelerate.

Federal Solar Tax Credits for Businesses Department of Energy, The energy efficient home improvement credit lets homeowners claim up to $3,200 per year for eligible upgrades, such as energy efficient windows, ac units, and. Energy efficiency tax credits for 2025 update:

Federal Tax Credit for Saving Money on Solar Panels KC Green Energy, $250 per door (up to $500 per year) exterior windows and skylights, central a/c units,. Specifically, credit limits will be the following:

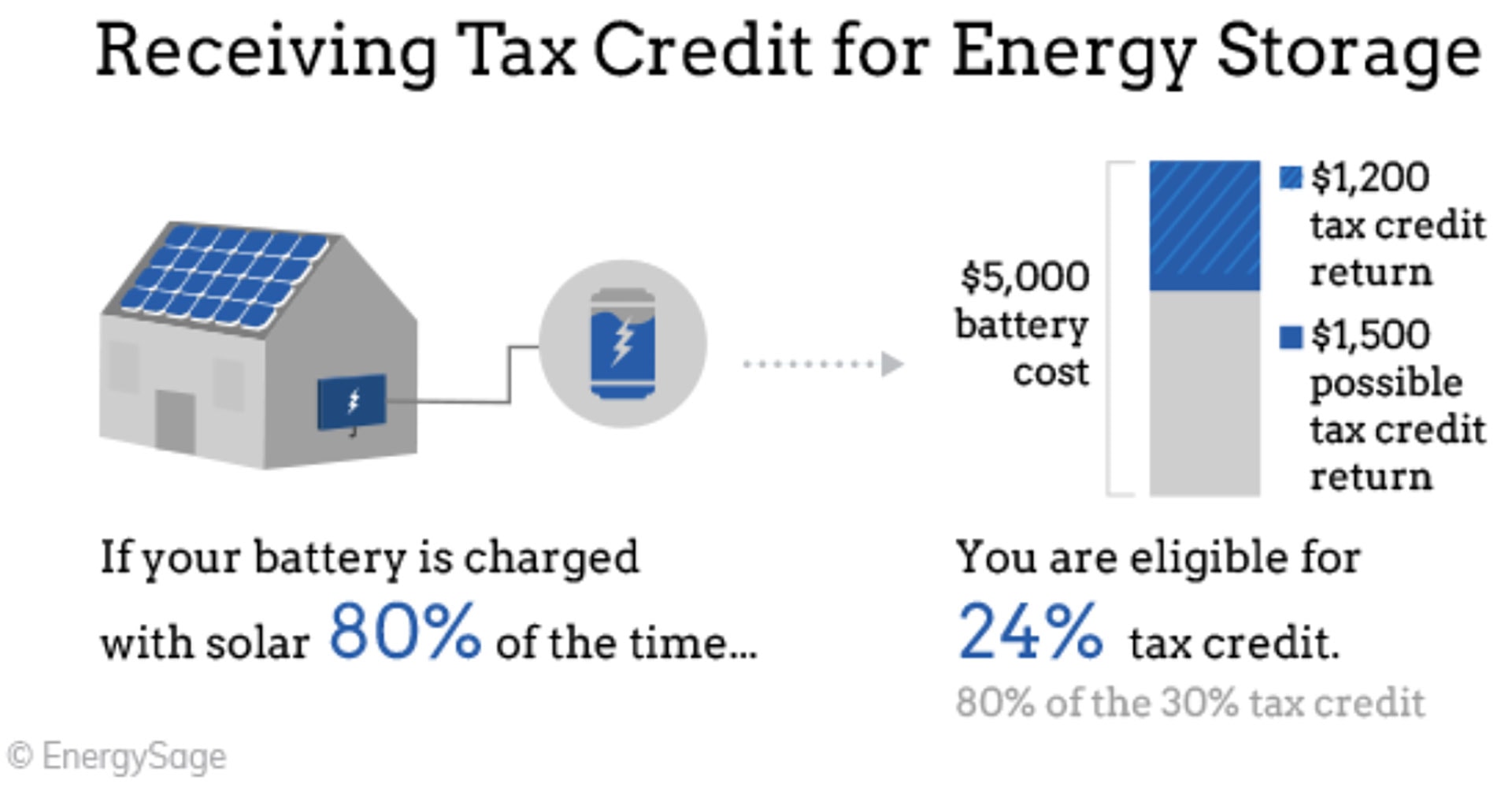

Final Days of the 30 ITC Solar and Energy Storage Tax Credit Briggs, $250 per door (up to $500 per year) exterior windows and skylights, central a/c units,. The tax credits listed below became available on january 1, 2025 and can be claimed when you file your income taxes for 2025.

Unpacking the new solar energy tax credit BDO, If you don’t qualify for. Energy efficiency tax credits for 2025 update:

Solar Energy Tax Credits by State MD, NJ, PA, VA, DC, FL, The inflation reduction act modifies and extends the clean energy investment tax credit to provide up to a 30% credit for qualifying investments in wind,. Clean energy tax credits for consumers.

2025 Energy Tax Credits CM Heating, Maybe you already knew about the credits, but there's more to learn about how to get the most out of them. Visit our energy savings hub to learn more about saving money.

Federal Solar Tax Credit Extended Through 2025, The tax credits listed below became available on january 1, 2025 and can be claimed when you file your income taxes for 2025. The energy efficient home improvement credit for 2025 is 30% of eligible expenses up to a maximum of $3,200.

.png)

Tax credits available for making efficiency improvements Heartland Energy, Two tax credits for renewable energy and energy efficiency home improvements have been extended through 2034 and expanded starting in 2025. The inflation reduction act of 2025 brought with it a collection of energy tax credits for american households.

Solar Energy Tax Credits by State MD, NJ, PA, VA, DC, FL, The rebates can help you save money on select home improvement projects that can lower your energy bills. The energy efficient home improvement credit for 2025 is 30% of eligible expenses up to a maximum of $3,200.

Energy Tax Credits for 2025, Find out what they are and how they can save you. A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero.

Travel Hiking WordPress Theme By WP Elemento